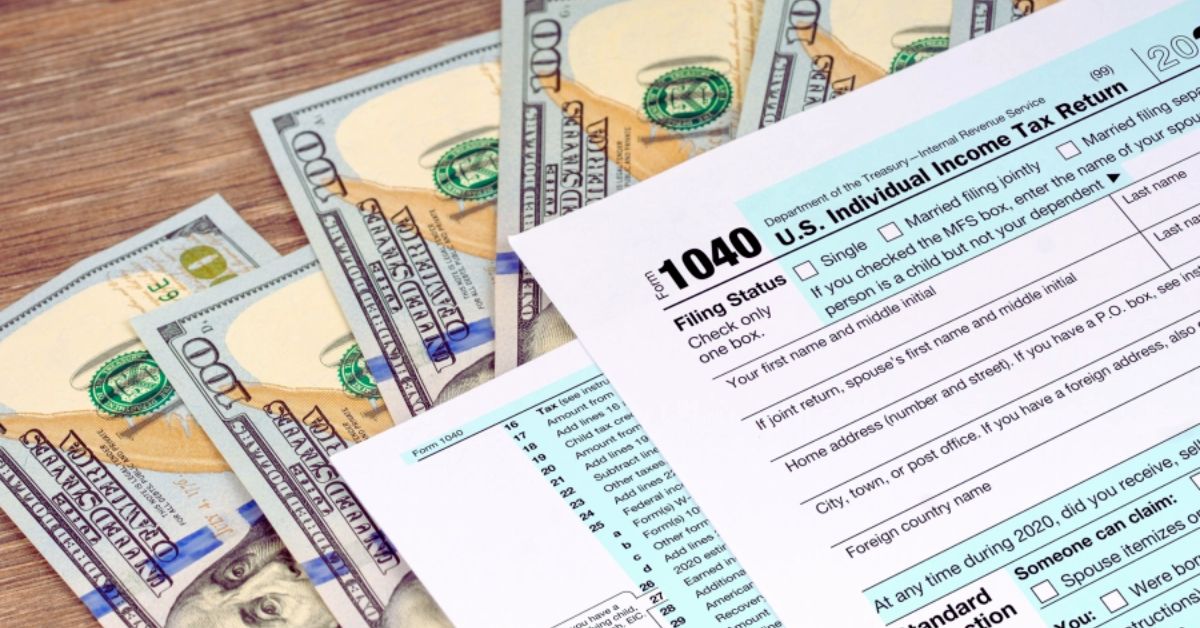

About 24,000 Oregonians are expected to have refunds totaling about $22 million held by the IRS because they still need to submit their 2019 tax forms, the agency said on Wednesday. Just three months remain until the government retains the money, so hurry up and collect!

The Internal Revenue Service (IRS) issues a reminder every year that it is getting close to the deadline for collecting unfiled tax returns. The statutory time limit for filing a tax return and receiving a refund is three years. The U.S. Treasury collects unclaimed refunds.

These back tax returns are often due in April, just around tax time. However, 2019 tax returns won’t be submitted until 2020 because of the COVID-19 epidemic. That puts this year’s cutoff on July 17th.

“With the pandemic taking place when the 2019 tax returns were originally due, people faced extremely unusual situations. People may have simply forgotten about tax refunds with the deadline that year postponed all the way into July,” IRS Commissioner Danny Werfel said in a statement.

“We frequently see students, part-time workers, and others with little income overlook filing a tax return and never realize they may be owed a refund. We encourage people to review their records and start gathering records now so they don’t run the risk of missing the July deadline.”

An estimated 23,700 taxpayers are eligible for a $22.3 million IRS refund. In Oregon, the average possible refund is $801. In other words, some reimbursements will be larger than others. However, there is the possibility for much more significant financial loss, especially for individuals with lower and middle incomes.

They could be qualified to claim the Earned Income Tax Credit. In 2019 terms, it might be worth as much as $6,557. According to the IRS, there are 1.5 million persons nationwide who are due a total of $1.5 billion, with the average refund amounting to $893.

The average reimbursement in Washington is $934. It costs $758 in Idaho. It’s $856 in the Golden State. Those who may qualify for the Earned Income Tax Credit in 2019 had annual salaries of:

- $50,162 ($55,952 if married filing jointly) for those with three or more qualifying children.

- $46,703 ($52,493 if married and filing jointly) for people with two qualifying children.

- $41,094 ($46,884 if married filing jointly) for those with one qualifying child

- $15,570 ($21,370 if married filing jointly) for people without qualifying children.

Visit the IRS’ Forms and Publications page or call 800-TAX-FORM (800-829-3676) to request or obtain a copy of a tax form and its accompanying instructions for the current tax year or any prior year.

Click These Links for Up-to-Date Information and Insights-

- Oregon Shakespeare Festival Appeals for $2.5 Million in Funding.

- Each Child in Oregon Might Get a Yearly Stimulus of $3,600.

Possibly Eligible Residents of Each State for a Tax Refund in 2019

State or District | Estimated Number of Individuals | Median Potential Refund | Total Potential Refunds* |

Alabama | 23,900 | $880 | $23,694,700 |

Alaska | 6,000 | $917 | $6,542,300 |

Arizona | 35,400 | $824 | $33,911,500 |

Arkansas | 12,800 | $864 | $12,586,100 |

California | 144,700 | $856 | $141,780,000 |

Colorado | 30,100 | $859 | $29,514,000 |

Connecticut | 15,400 | $934 | $16,198,400 |

Delaware | 5,700 | $880 | $5,754,900 |

District of Columbia | 4,400 | $887 | $4,550,100 |

Florida | 89,300 | $893 | $89,530,400 |

Georgia | 48,000 | $826 | $46,269,000 |

Hawaii | 8,800 | $932 | $9,197,700 |

Idaho | 7,600 | $758 | $6,996,000 |

Illinois | 55,800 | $916 | $57,591,300 |

Indiana | 31,700 | $916 | $32,115,100 |

Iowa | 15,300 | $926 | $15,492,600 |

Kansas | 14,600 | $913 | $14,753,700 |

Kentucky | 18,600 | $906 | $18,574,200 |

Louisiana | 22,000 | $877 | $22,274,800 |

Maine | 6,400 | $876 | $6,197,300 |

Maryland | 31,400 | $897 | $32,344,500 |

Massachusetts | 35,700 | $966 | $38,400,900 |

Michigan | 48,500 | $888 | $48,582,600 |

Minnesota | 23,200 | $848 | $22,387,800 |

Mississippi | 12,300 | $820 | $11,836,700 |

Missouri | 31,800 | $880 | $31,345,700 |

Montana | 5,200 | $854 | $5,144,900 |

Nebraska | 7,800 | $893 | $7,745,600 |

Nevada | 15,800 | $869 | $15,550,300 |

New Hampshire | 6,900 | $974 | $7,451,800 |

New Jersey | 40,500 | $924 | $42,035,900 |

New Mexico | 9,600 | $867 | $9,522,400 |

New York | 81,600 | $945 | $86,826,200 |

North Carolina | 45,800 | $862 | $44,426,600 |

North Dakota | 3,700 | $958 | $3,997,100 |

Ohio | 51,800 | $868 | $50,234,900 |

Oklahoma | 21,400 | $897 | $21,770,000 |

Oregon | 23,700 | $801 | $22,348,900 |

Pennsylvania | 56,000 | $924 | $57,572,600 |

Rhode Island | 4,300 | $924 | $4,468,700 |

South Carolina | 18,200 | $809 | $17,264,100 |

South Dakota | 3,700 | $918 | $3,746,700 |

Tennessee | 28,100 | $873 | $27,623,700 |

Texas | 135,300 | $924 | $142,235,200 |

Utah | 11,700 | $845 | $11,198,400 |

Vermont | 3,100 | $901 | $3,036,600 |

Virginia | 42,200 | $869 | $42,110,500 |

Washington | 42,400 | $934 | $44,823,200 |

West Virginia | 6,500 | $959 | $6,818,900 |

Wisconsin | 21,000 | $834 | $20,003,100 |

Wyoming | 3,300 | $949 | $3,534,800 |

Totals | 1,469,000 | $893 | $1,479,913,400 |

* Excluding credits.

Our website is a great place to catch up on the most recent news stories we’ve written about.